LogicManager's ERM & Corporate Governance Program

Demonstrate Strong Corporate Governance and Risk Management to the Board

Since November 2006, LogicManager’s Risk Management and Corporate Governance Program has been adopted by over 3,000 organizations worldwide. Chief Risk Officers and their teams leverage this program to benchmark against industry best practices across 7 attributes, 25 success factors, and 71 competency drivers. Here’s how it empowers your organization:

- Engage Risk Champions: Collaborate with risk management champions at various levels and across business silos.

- Set Obtainable Milestones: Build consensus for achievable quarterly milestones.

- Clear Communication: Articulate your risk management process clearly to the board, risk committee, rating agencies, executive management, regulators, auditors, and other stakeholders.

The Risk Maturity Model (RMM), backed by peer-reviewed research, demonstrates that mature ERM programs yield a 25% higher market value. The program begins with a 45-minute RMM readiness assessment, aggregating results from risk champions to evaluate your organization’s risk management and corporate governance maturity.

Try the limited free assessment online today.

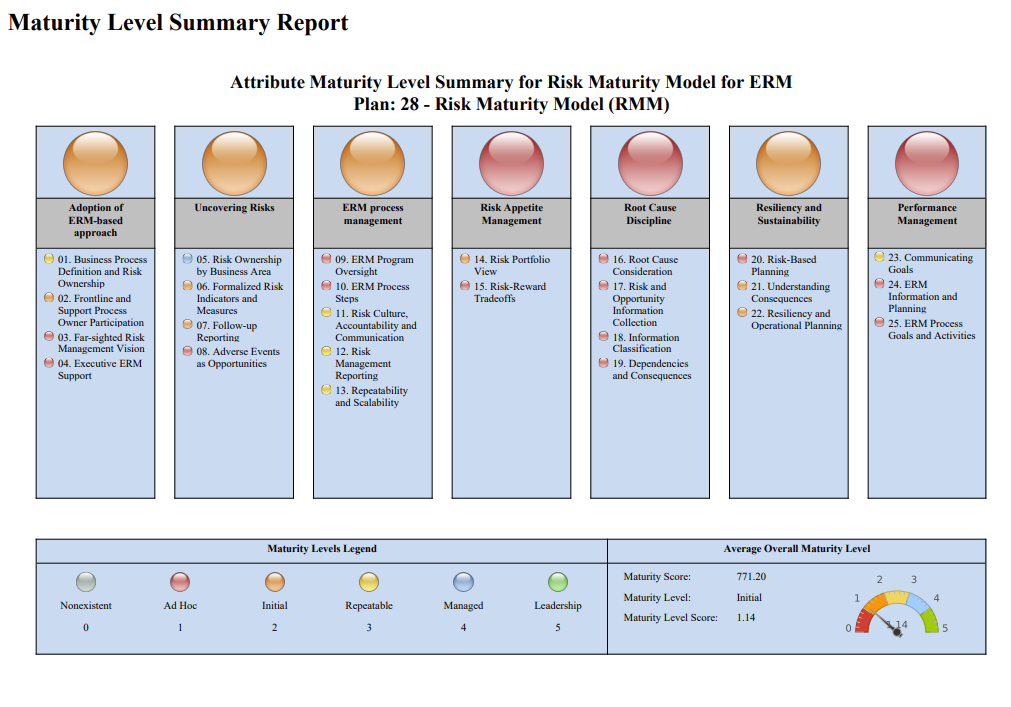

Measure Your Risk Maturity

Risk leaders use the risk maturity summary report to demonstrate that their risk management process aligns with quality expectations and fiduciary duty oversight standards. The report ensures that your organization:

- Sustains a Relevant ERM Charter

- Builds Timely Action Plans

- Sets Milestones for Resource Allocations

For efficient and strategic decision-making, LogicManager’s integrated approach bridges silos, detects dependencies, and optimizes resource allocation while reducing redundancy.

Complimentary DownloadERM & Corporate Governance Program Audit Guide

Auditors use the Risk Maturity Model (RMM) Audit Guide to evaluate their organization’s risk processes within the Enterprise Risk Management (ERM) program’s charter. This guide provides an evidence-based framework, outlining 25 success factors and 71 competency driver standards, for audit teams to ensure accuracy and reliability in risk-related data and statements to support disclosures in 10K and 10Q reports. Here’s how auditors utilize the RMM Audit Guide:

Validation and Alignment

Auditors validate if the program aligns with the board’s risk appetite. They verify components like risk identification, assessment, mitigation, monitoring, and escalation processes to ensure reasonable care in oversight and prevent negligence, waste, and fraud.

Measuring Program Effectiveness

Using the RMM guide, auditors analyze metrics against industry benchmarks. This helps them gauge the organization’s program effectiveness and promptly address any concerns by implementing corrective measures.

Data Accuracy and Training

Auditors use the guide to train their teams, ensuring that reported risks meet fiduciary duty standards set by board members and leadership. Effective communication with regulators, external auditors, investors, and stakeholders is a key outcome of this approach.

“In larger organizations, there is considerable “risk silo creation” and different progress in each. You helped us consider a common framework across our silos (eg Operational Risk, Digital Security, Crisis & Continuity Management, General Security etc).”

– Business Continuity SME

Frequently Asked QuestionsFoundations of Corporate Governance

Corporate governance software enhances decision-making processes through several key features:

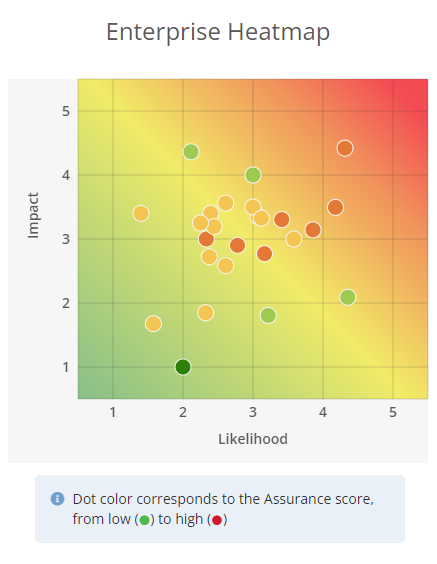

- Resource Comparison Dashboard: Facilitates a holistic comparison of enterprise resources against standardized risk dimensions and criteria. It empowers decision-makers to prioritize resource allocation based on risk exposure, thereby enhancing resource efficiency and fortifying the organization’s risk posture.

- Measuring Corporate Governance: Provides organizations with clearer insights into potential threats and opportunities through effective risk management visuals and dashboards. This allows stakeholders to make informed decisions by gaining real-time insights into the overall risk landscape, thereby facilitating better-informed decision-making.

- Uncover and Take Action on Systemic Risk: Promotes collaboration between departments to understand and mitigate systemic risks across the organization. This mitigates critical risks identified across multiple departments, indicating organization-wide challenges and fostering cross-departmental collaboration.

- Analyze and Prioritize Your Organization’s Resources: Enables businesses to gain insight into critical resources to prioritize and allocate resources efficiently. This aligns business objectives with risk levels for compliance, risk mitigation, and strategic decision-making, enhancing transparency, accountability, and overall organizational resilience in line with strong corporate governance principles.

Corporate governance software impacts stakeholder communication by offering features that foster transparency and inclusivity. The software enhances stakeholder communication through:

- Enhanced Transparency: It provides a central repository for all risk-related information, which is easily accessible by stakeholders. This leads to increased transparency within the organization, as stakeholders have a comprehensive view of the risk landscape and the decisions being made to manage those risks.

- Improves Stakeholder Involvement: Through advanced notification systems and dashboards, corporate governance software ensures that relevant stakeholders are kept informed about potential risks and are included in the decision-making process. This system enhances collaboration across departments and ensures that stakeholder input is considered in risk management strategies and decision-making processes.

- Comprehensive Reporting: The software allows for the generation of detailed reports on the organization’s risk management strategies and outcomes. These reports can be shared with stakeholders to keep them informed of the organization’s risk posture, the measures taken to mitigate risks, and the results of those actions. This type of reporting not only keeps stakeholders informed but also builds trust by demonstrating the organization’s commitment to effective risk management and corporate governance. These features collectively enhance stakeholder communication by promoting a culture of transparency, accountability, and informed engagement across the organization.

The term implies that the board is exercising a level of care that is considered reasonable and appropriate in fulfilling its oversight responsibilities, which includes preventing negligence, waste, and fraud.

The Risk Maturity Model (RMM) is a best practice framework and risk maturity assessment tool authored by LogicManager in 2005, in collaboration with the Risk and Insurance Management Society (RIMS). The RMM helps organizations across industries benchmark their risk management capabilities, identify strengths, and understand weak links that inhibit further ERM performance. By using the RMM, organizations can develop and improve sustainable enterprise risk management programs that provide a direct link to business value and performance. A mature ERM program sees gaps in processes as opportunities for improved performance and takes steps to effectively identify, mitigate, and monitor risks, thereby lowering the overall risk level of the organization. Today, the RMM is available within the LogicManager application for professionals and executives to use.

Not only can the RMM help you measure your current risk maturity, but the LogicManager platform will help you execute on improving your program over time and become more mature in the long run. The RMM allows organizations to score their risk programs on a five-level scale, and receive an immediate downloadable report, which provides information not only on current maturity levels as well as ideas on what it may take to achieve a higher level of maturity in each of seven attributes. The Risk Maturity Model provides an actionable internal guide that corporations of all sizes, industries, and geographies can use to improve their enterprise risk management maturity from whatever level they are at today.

Every department within your organization holds risk. The natural extension of this means that every department then also benefits from a mature risk management program, that helps mitigate and manage that risk. If these processes aren’t being done throughout your organization, you aren’t gaining the benefits of a mature program. Without evaluating the maturity of your program, you increase the risk of misalignment between your ERM team and the frontlines of your organization.

A mature risk management program also helps mitigate the risk of negligence within your organization. In order to not be found negligent, you must have a way of proving that the risks that materialized into the incident leading to the negligence claim were disclosed to your stakeholders. This is always addressed in a mature ERM program.

Related PackagesYou May Also Like…

Take a Limited Free Trial Assessment Today

Take the risk maturity assessment to discover your unique enterprise risk management maturity score. After completing this limited free trial assessment, you’ll receive a personalized ERM benchmarking report that directly compares your results against the Risk Maturity Model’s umbrella framework to identify gaps and prioritize the next steps for your ERM program. This will help you develop an action plan to take your program to the next level. The assessment requires no prior experience and takes about 30 minutes to complete.