What is a Risk Assessment? [Complete Guide]

Last Updated: September 19, 2023

The hallmark of any healthy risk management program is the ability to assess risk in a uniform fashion. Are your risk assessments built on a foundation of best practices to help you understand your risks in their entirety? This guide will discuss what is a risk assessment, why is a risk assessment important, when in the risk management process should you complete the risk assessment, risk assessment scaling criteria, risk assessment best practices, an example of a risk assessment and finally concrete solutions to completing better risk assessments.

Table of Contents

What is a Risk Assessment?

Simply put, completing a risk assessment is the process of analyzing the specifics of different risks faced by your workplace.

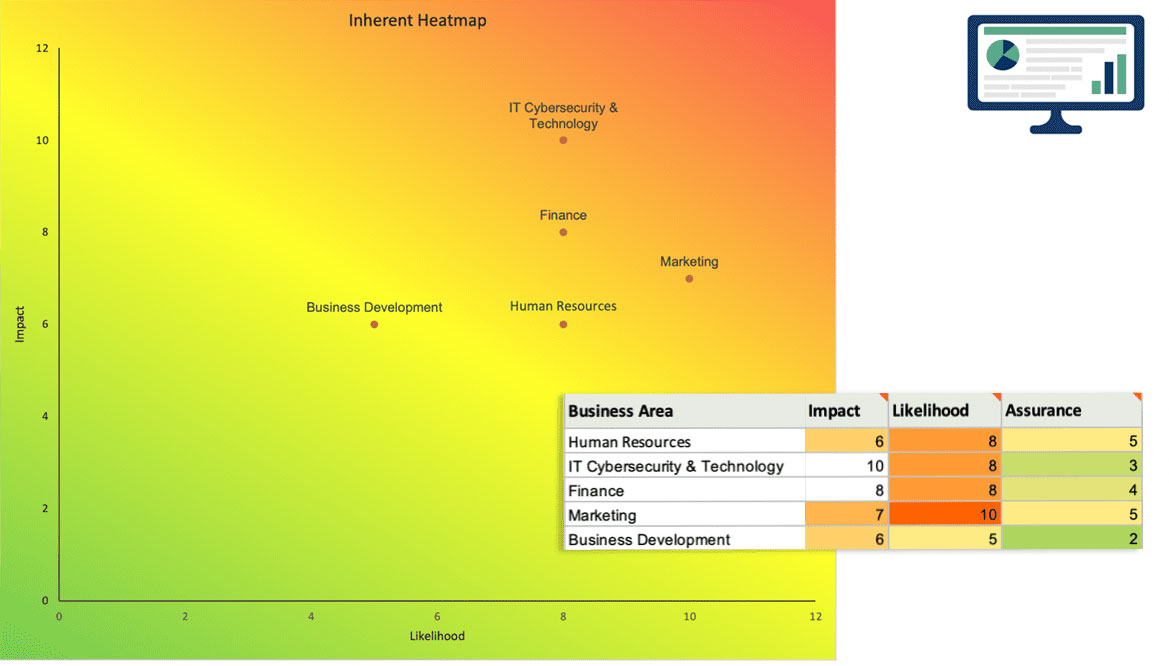

On a more complex level, going through the risk assessment process will reveal granular levels of each of those risks, including their impact, likelihood and assurance. This helps you more clearly see the consequences of certain risks materializing, especially when used with a great risk management plan.

Why is a Risk Assessment Important?

At its core, the risk assessment process is intended to help you make better decisions to add value to your workplace. Better decision-making requires transparency into all risk information gathered at your organization. It also requires the ability to prioritize that information by assessing the risks related to your organizational goals, resources, and more.

Risk assessments help you take a look at where you spend time and money so you can prioritize resources and resolve confusing or contentious issues. Nevertheless, controls, tests, tasks, and resources are expensive; risk assessments add priority to these activities to help you and your employees understand how critical each one is.

So what happens if you fail to complete a risk assessment as part of your risk management process? By failing to prioritize the right activities, you’ll likely see the following consequences:

Lack of Continuity: Changes in your workplace may cause you to create new activities, even though existing ones are more effective.

Lack of Coordination: Activities often apply to multiple risks or commitments across functional lines. The inability to formally tie activities to risk or commitments hinders inter-functional coordination, resulting in silos and duplicative work.

Activity Fatigue: Staff may ignore certain activities because of a lack of time to assess them.

Wasted Resources: If a risk changes, most organizations have no way of knowing how (or even if) these changes will impact their resources and activities.

Activity Obsolescence: In a changing environment, there is no effective way to know when activities no longer apply.

Lack of Prioritization: Picking activities to focus on is likely to be on an ad hoc basis and subject to the whims of current staff.

What Is The Risk Assessment Process?

You may struggle to decide when is the best time to complete a risk assessment. After all, it can be an iterative risk assessment process that requires due diligence and hinges on the results of other time-consuming research. Here is the order of operations we recommend – as you’ll see, completing the risk assessment is step 2 in the overall risk assessment process of your risk management efforts:

Identify

The first step of the risk assessment process involves identifying risk across your organization should be step 1 when developing your risk management program. Note: it’s not enough to simply identify what happened; the most effective risk identification techniques focus on root cause.

This allows you to identify systemic issues so that you can design controls that eliminate the cost and time of duplicate effort.

You can read more about risk identification by clicking here.

Assess & Prioritize

Assessing level of risk in a uniform fashion is the hallmark of a healthy risk management system.

Risk analysis allows you to determine the likelihood of any given level of risk and subsequently prioritize your remediation efforts.

You can find out more about the risk prioritization process here.

Mitigate

Risk mitigation is the process of introducing measures aimed at reducing risk exposure and minimizing the likelihood of an incident through effective control measures. You can view the complete risk mitigation guide here.

Your top risks and concerns need to be continually addressed to ensure your workplace is fully protected. There are certain risk mitigation best practices that you can follow to ensure that you are mitigating your risks correctly.

Monitor

Monitoring and taking time to identify potential hazards that could cause harm should be an ongoing and proactive review process. It involves testing, metric collection and incidents remediation to certify that your controls are effective through a review process. It also allows you to identify, review and address emerging trends to determine whether or not you’re making progress on your initiatives.

Connect

Create relationships between potential hazards and risks that could cause harm, workplace units, mitigation activities and more to create a cohesive picture of your organization. This allows you to recognize upstream and downstream dependencies, identify systemic risks and design centralized controls. When you eliminate silos, you eliminate the chances of missing critical pieces of information.

Risk Metrics Report

Presenting information about your risk management program in an engaging way demonstrates effectiveness and can rally the support of various stakeholders. This is an integral part of the risk assessment process. Develop a key risk indicators report that centralizes your information and gives a dynamic view of your company’s risk profile.

Risk Assessment Evaluation Scale

Your risks should be assessed based on the Impact, Likelihood and Assurance of them occurring. Once this system is in place for labeling or identifying risk, you should begin assessing the potential impact of each risk based on a standard set of criteria. A lot of organizations use a high-medium-low scale to assess their risks, but this actually isn’t best practice.

High-medium and low scales make it difficult and time-consuming to quantify, aggregate, and objectively rank information. With only three options from employees to choose from, they’ll likely feel conflicted about which one to choose. Many employees may even feel compelled to write in a medium/high option.

In reality, best practice favors a 1-10 scale, with 10 having the most unfavorable consequences to the organization. Using a 1-10 scale makes calculating the residual index score of a risk more straightforward. This gives employees more flexibility in their assessments will increase accuracy, and more confidence when determining what your top risks really are. The 10-point scale should be distributed as follows:

1-2: Insignificant

3-4: Minor

5-6: Moderate

7-8: Serious

9-10: Major

Risk Assessment Best Practices

In order to truly improve your company’s risk program, it’s critical to conduct objective, enterprise-wide risk assessments. But what else is best practice for conducting a risk assessment?

Best Practice #1: Take a root-cause approach.

The most effective way to collect risk data is to identify risk by root cause. Root cause tells us why an event occurs, which provides information about what triggers a loss and where an organization is vulnerable. Using root-cause categories provides meaningful context as to what steps to take to mitigate risk.

Best Practice #2: Standardize your scales and criteria through templates.

We talked earlier about the 1-10 scale. You need defined evaluation criteria because too often, one person’s 9 is another person’s 7. You should provide a clear, unambiguous definition for each of the 5 buckets we mentioned above. The key is to express severity in both quantitative and qualitative terms in a standardized way. Each bucket should have a variation of these themes applicable to each level of severity.

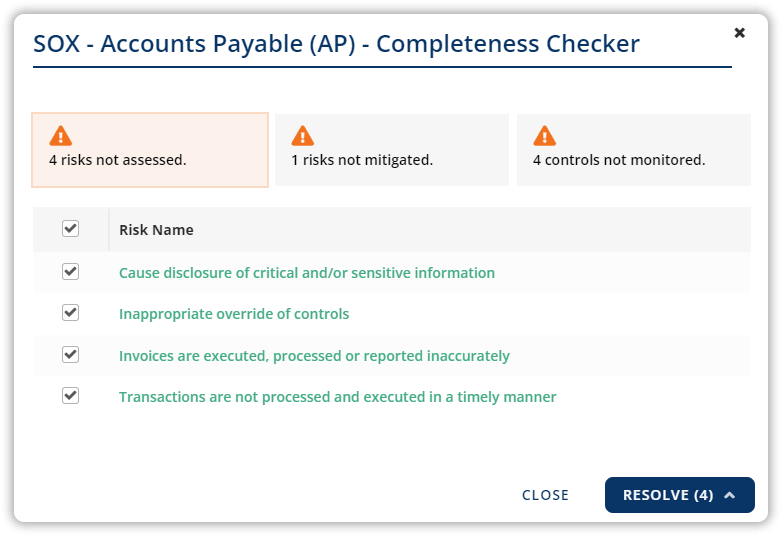

Best Practice #3: Link risks to controls.

Once you have identified the source of risks and assessed them objectively, you need to know how controls are actually covering risks. Oftentimes, the knowledge of how the risk is mitigated is only a conversational explanation from the business area in facilitated sessions. Maintaining a system where risks are directly linked to their controls helps you maintain better governance over mitigation activities. With such a system, you have a valuable record of when and why different controls were created, as well as the proof you need for auditors to show that your workplace is actively working to manage risk.

Best Practice #4: Connect risks to strategic goals.

Getting an accurate pulse on strategic priorities is challenging because these types of organizational goals are cross-functional in nature. And while they are extremely useful for the board and senior executives, they are impossible to act upon without operationalizing them (breaking them down into root-cause, silo-specific activities within business areas). Taking a risk-based approach helps you prioritize in a strategic way.

Best Practice #5: Embed risk assessments in your everyday activities.

At the end of the day, better risk assessments can only be fostered by engagement, and this is the hardest part. The good news is, when it comes to business, people love success and efficiency. So be your own business case! Start to use your own experience and successes to get others to see the value involved. Risk is in everyone’s job responsibilities. The more integrated ERM is in everyone’s job descriptions, the easier risk assessments will become and the more valuable they will be, but this may take time. Start integrating ERM into everyone’s day-to-day activities by starting with your own area.

Risk Assessment Example

As an example, let’s look at an experience most companies face: professional liability insurance applications. Insurance companies require seemingly innocuous assertions about the management of your organization’s operations and governance. Among other activities, they seek information on your operational controls, management of content and privacy exposures, computer systems controls, computer system access protection, data backup procedures and data encryption procedures.

Additionally, we see risk management failures covering a wide range of sectors from the Chipotle scandal (Food Safety News) to banking customer outages (The Hill).

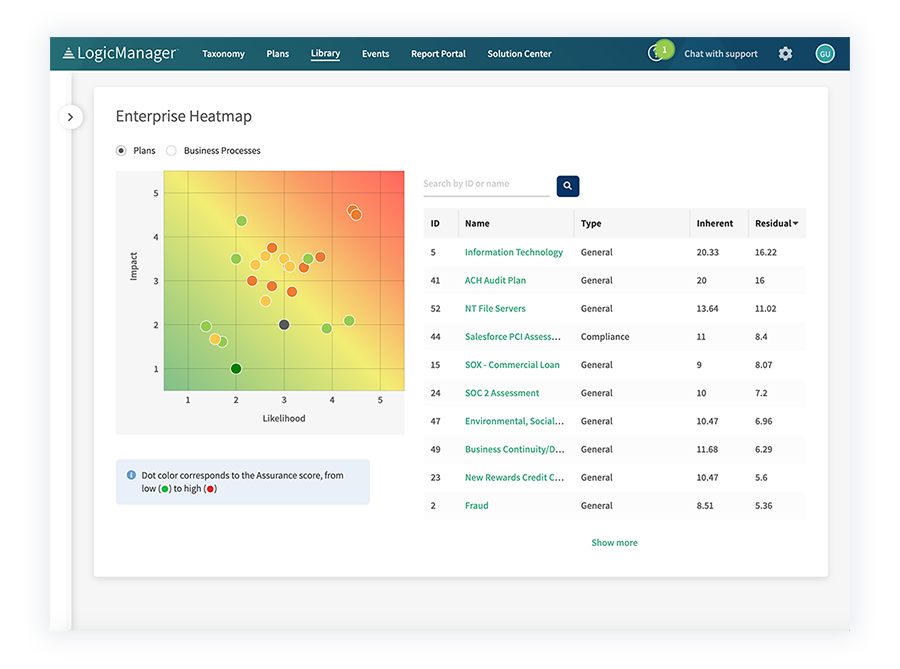

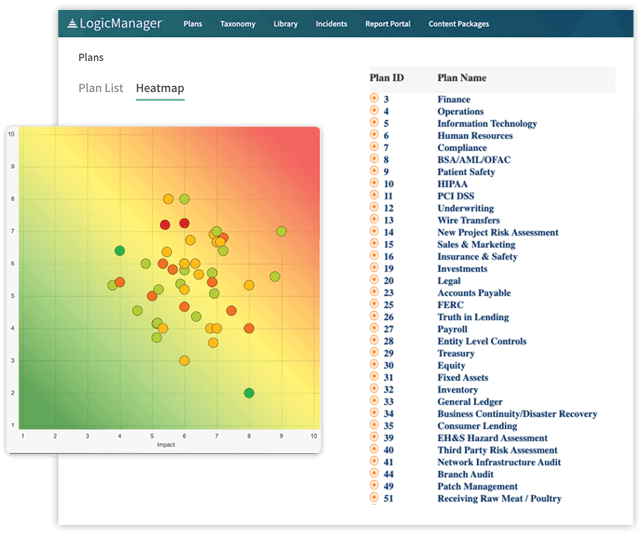

Assess Your Risks with LogicManager

The more integrated ERM is in everyone’s job descriptions, the easier risk assessments will become and the more valuable they will be, but this may take time. Start integrating ERM into everyone’s day-to-day activities by leveraging LogicManager’s ERM platform today.

By applying a risk-based approach, you can more easily prioritize existing activities, manage change, objectify conclusions to enable better issue escalation and gain a panoramic view of disparate controls and tests. All of this will help you streamline and add value to current activities, enabling you to spend less time on check-the-box compliance or insurance efforts and more time preventing loss events and identifying emerging risks.

Conclusion

No matter what your industry, company size, risks or unique challenges may be, LogicManager has a fully integrated risk assessment solution that works to tackle all of your risk needs and manage risks that can cause harm in one place.

We also have nearly 100 point solutions so you can cherry-pick based on your most specific and timely needs as risk assessments play an important role in defining what is ERM to any organization.

Interested in seeing just how LogicManager’s software empowers better risk assessments? Schedule a demo today to find out!