Third Party Risk Management

Protect Your Reputation with TPRM Software

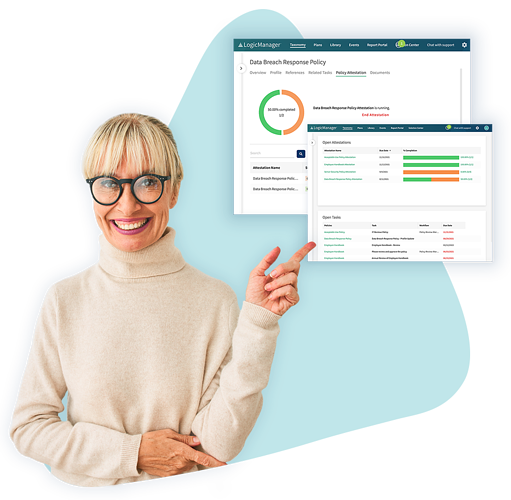

You can’t control your third parties– but you can control the reputational risks that come with partnering with third parties. LogicManager’s holistic bundle is your go-to solution for mitigating third-party risks.

- Collaborate with third parties to get the crucial information you need– using one, customizable interface.

- Track time-sensitive tasks, like review dates and contract renewals, with recurring tasks, alerts, and reminders.

- Identify critical third parties and their associated risks using intuitive, objective risk assessments.

- Bolster compliance by mapping third-party controls and assessments to internal policies and external regulations with our taxonomy technology.

- Leverage AI to automatically extract crucial terms from contracts, ensuring no essential details go unnoticed, enabling informed decisions based on comprehensive contract insights, and initiating contract reviews automatically to prevent missing key dates.

You might also like:

Why Logicmanager? – Users of LogicManager’s ERM software explain how their TPRM programs have benefited from our platform and expert advisory service.

Customer Success StoriesExplore How Companies Overcame Challenges With Our TPRM Solution

Risk-Based Third-Party Management in the Financial Industry

How one bank used LogicManager to overcome third-party risk management challenges and achieve success

Customer Value Story: How to Know What You Don’t Know

Learn how one client streamlined and automated their third-party contract management program using LogicManager’s AI-powered contract analyzer

What Our Customers Are Saying...

The LogicManager DifferenceA Holistic Approach to Third-Party Risk Management (TPRM)

Business Decision InsightsFocus on What’s Important

Through our ERM software, we allow our customers to spend more time strategically managing risks– and less time on tedious administrative activities, like data cleansing and manipulation. Our solution enhances efficiency while bringing “unknown knowns” that risk managers might miss to the surface, allowing you to accurately assess the criticality of your suppliers and allocate resources accordingly.

Customer ExperienceStreamline Your Risk Management Program

Unlike other software that requires IT professional customization, our solution allows customers to control engagement through an end-user configuration. This approach enables faster time-to-value and allows organizations to evolve their programs over time, not to mention a quicker return on investment. With seamless integration, you can engage the right vendors at the right time.

Risk-Based ApproachPrepare for Tomorrow’s Surprises Today

A risk-based approach is the key to effective governance, risk, and compliance. This process enables sound prioritization across organizational silos, identifies challenges and critical dependencies, and proper resource allocation. With a risk-based mindset, organizations can better deploy resources to valuable areas, and high-level risk vendor concerns can more easily surface– and be appropriately mitigated. While you can’t control your vendors, you can control accompanying third-party risks.

CapabilitiesAn All-In-One Third Party Risk Management Platform

Frequently Asked QuestionsFoundations of Third Party Risk Management

Working with third parties can come with risks. As outsourcing, automation, and customer expectations accelerate the course of business, third-party management programs need to connect and streamline their processes to keep up.

Effective third-party risk management enables organizations to maximize the value of third-party relationships by controlling costs, strengthening operations, and reducing the risks inherent to outsourcing.

This area of governance has a lot of moving parts: who your third parties are, what services they provide, what sensitive information they have access to, which internal policies apply to them, and so much more.

At its core, the goal of risk management is to make better decisions to add business value. Better decision-making requires transparency into all risk information gathered at your organization. It also requires the ability to prioritize that information by assessing the risks related to organizational goals, resources, controls, and monitoring.

Business value means looking at where you spend time and money so you can prioritize resources and resolve confusing or contentious issues. Nevertheless, controls, tests, tasks, and resources are very expensive. Third-party risk assessments add priority to these activities, helping you understand how critical each one is.

By adopting a standardized and objective best-practice risk assessment methodology, you can start to identify the overlapping activities that crowd your program, prioritize actions, and help your organization make more informed decisions.

There are five best practices for effective third-party risk management: a root-cause approach, a standardized assessment scale and criteria, links to controls, connecting risks to strategic goals, and embedding ERM in everyday activities.

The terms vendor, third party, and partner are often used interchangeably, but there are subtle differences.

- Vendor– Typically a company that supplies a service or product, such as software.

- Third-party– A group from outside the company brought in to solve a problem, such as consultants.

- Partners– A business partner that has a strong financial and operating relationship with a company, often with frequent interaction and dependence.

Request a DemoLearn How LogicManager’s Third Party Risk Management Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.