PCI DSS Compliance Software Tools

The Payment Card Industry Data Security Standard (or PCI DSS) is a set of requirements intended to ensure that all companies that process, store or transmit credit card information maintain a secure environment. If your business accepts, stores or transmits cardholder data, then PCI DSS pertains to you.

Streamline your efforts to achieve and maintain PCI DSS compliance with LogicManager’s comprehensive PCI Compliance package.

For additional value:

Why a Risk-Based Approach to PCI Compliance is Important:

How LogicManager’s PCI Compliance Solution Helps

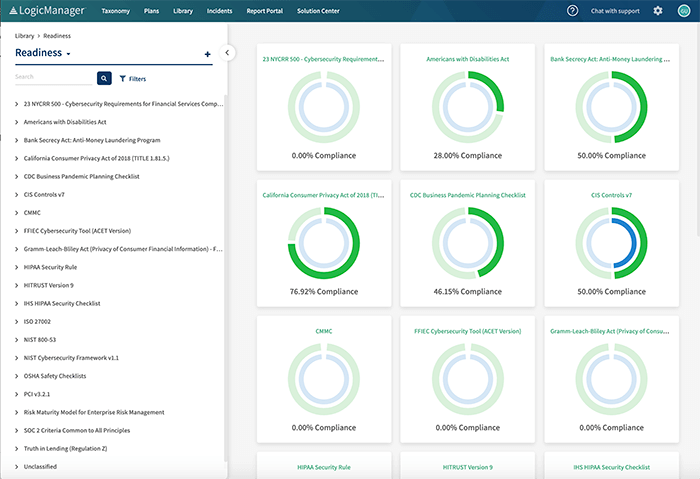

- Personalized LogicManager home screens help simplify the complex process of implementing PCI standards by bringing your IT team directly to the information they need, such as a readiness dashboard or their list of open tasks.

- Our PCI Readiness Assessment breaks down compliance requirements into individual responsibilities, distributes tasks to activity owners and links them to your existing controls to be documented as evidence along the way.

- LogicManager’s One-Click Compliance AI searches through your existing library of IT controls, policies and procedures and suggests which ones to leverage for demonstrating alignment with PCI DSS, reducing internal labor costs of compliance.

- Monitor your compliance with PCI DSS with automated testing to be able to provide evidence of your alignment to the requirements over time.

- Use our Reporting & Dashboard tools to visualize control deficiencies, historical results of alignment with each of the 12 core requirements, readiness summaries, testing calendars and more to continually improve your program.

COMPLIMENTARY DOWNLOAD:

Risk Based Compliance eBook

Risk Based Compliance eBook

This eBook offers actionable, best practice steps for implementing risk-based compliance at your organization.

Achieve PCI Compliance with LogicManager

Maintain a centralized repository

By utilizing LogicManager, you can centrally oversee your PCI assessment. Delegate tasks to the appropriate personnel, engage other departments and teams as appropriate, identify gaps quickly and gain insights into common controls. This centralized approach helps prevent the loss of information because you no longer have to account for differences in how different departments track information, and you have a full audit trail of task creation, completion and any changes made along the way (reducing any “he said / she said” scenarios).

Satisfy examiners

Having a centralized platform makes it easier to satisfy examiners. Examiners often ask for documentation on controls, task history (i.e. when a gap assessment was completed), evidence of controls reviews, and proof that any issues identified were remediated. Instead of spending countless weeks collecting loose spreadsheets and files of paperwork from various departments, you can easily access all the information in one centralized location, and provide examiners with reports covering the evidence that they are looking for.

Identify critical gaps

By completing a simple “yes/no” survey against the PCI DSS checklist, your organization will be able to easily identify gaps in the program. Any time you answer “no” to meeting one of the checklist requirements, the best practice should be flagging an issue to track: What is your plan to ensure your organization meets that requirement? Is the lack of compliance mostly linked to one specific department or branch?

LogicManager allows you to track and report on this information so that you can identify the weaknesses and begin the work of implementing new controls, policies and procedures to help you comply with PCI DSS requirements.

What is the PCI DSS?

The Payment Card Industry Data Security Standard (or PCI DSS) is a set of requirements intended to ensure that all companies that process, store or transmit credit card information maintain a secure environment. If your business accepts, stores or transmits cardholder data, then PCI DSS pertains to your organization. You’ll be required to provide evidence of those controls and their effectiveness, and collecting that information manually would depend on countless hours and resources.

Not all merchants or their vendors are created equal, however, which is why there are 4 compliance levels (the higher the level your organization is, the more stringent the PCI DSS requirements will be) and are determined by which credit cards you accept and how many transactions you process in a year. For example, PCI DSS requires that all Level 1 businesses (those with more than 6 million transactions per year) undergo an annual audit.

By utilizing LogicManager, you can streamline the process of preparing for a PCI audit (e.g. assessing your risks and vulnerabilities, demonstrating your controls, etc.) and eliminate human error along the way. Complying with PCI DSS also makes it easier to comply with other security frameworks, such as NIST CSF or IT SOX. This means achieving PCI compliance = saving time and resources down the road.

Risks

So what can happen to your organization if you fall short in complying with PCI DSS? Noncompliance can lead to consequences such as monthly penalties, data breaches, legal action, damaged reputation and even revenue loss. PCI noncompliance can result in penalties ranging from $5,000 to $100,000 per month by the major Credit Card Companies (Visa, MasterCard, Discover, AMEX). The potential resulting financial, legal and reputational damages if you’re found to be noncompliant could mean the end of your organization entirely.

Request a DemoLearn How LogicManager’s PCI DSS Compliance Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.