Compliance Risk Assessments

Regulatory guidelines and compliance standards are designed to make sure your business is operating under the highest standards of honesty and integrity. With LogicManager’s Compliance Risk Assessment solution, your due diligence efforts will help your business excel while maintaining an exemplary reputation.

This application can be achieved through:

LogicManager’s Compliance Risk Assessment Solution

Here’s how you can leverage LogicManager’s Compliance Risk Assessment solution package:

- Receive personalized training by an expert Advisory Analyst team to confidently use the platform and bring your compliance program to its fullest potential.

- Access LogicManager’s out-of-the-box (yet entirely customizable) compliance specific risk assessments, which are based on industry frameworks, regulations and strategic best practices including:

- ACH

- BSA/AML

- Cybersecurity

- Deposit Operations

- Electronic Banking

- Fraud

- General Compliance

- NIST

- Red Flags

- Regulation Oversight

- Set up recurring tasks to automatically ensure that your compliance risk assessments are being updated or continue to be up to date year over year.

- Build out a robust, consolidated repository of mitigating controls that can be linked to multiple risks, risk assessments and monitoring activities.

- Leverage our AI-powered Suggested Mitigations tool, which allows you to quickly identify the controls that may help you mitigate your compliance risks best.

- Test the effectiveness of your controls through monitoring activities that are specifically designed to capture both qualitative and quantitative information.

- Gain access to a wide range of reporting tools detailing risk assessments, mitigations, monitoring activities and a combination of all three catered to different audiences. From regulators to executives and more.

- Easily pull field history to compare risk assessments at various times to determine how your compliance program has grown and evolved over the months and years. This can help you identify opportunities for improvement and provide accurate records to regulatory agencies and auditors alike.

Achieve your Compliance Risk Assessment with LogicManager

Take a risk-based approach

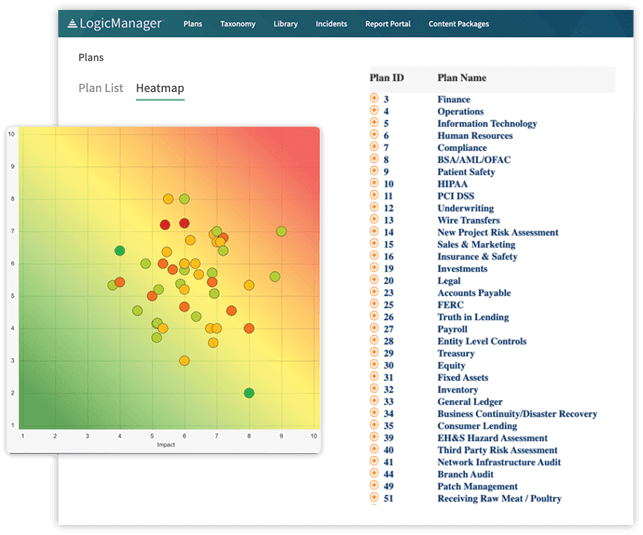

There may be a wide variety of regulations and laws that you must comply with, so naturally the risks associated with each of them vary greatly. LogicManager is built on a foundation of risk management best practices, which means you’ll inherently be taking a risk-based approach in everything you do. Our platform is designed to help you ensure that you’re prioritizing the areas that pose the greatest threats to your organization.

Streamline your processes

Save time and resources through the out-of-the box content and our automated tools, from workflows to task assignment and more. You can also easily reallocate resources based on which regulations pose the most risk to your organization, ensuring there is no duplicative or unnecessary work.

Increase engagement

LogicManager is built on a taxonomy framework, meaning it’s easy to communicate your needs to others and vice versa. Using an interconnected system to conduct your compliance risk assessments allows you to more easily engage with the front lines of your organization. to complete risk assessments in a timely and efficient manner, giving greater insight into the day-to-day processes of those closest to the operations

What is a Compliance Risk Assessment?

Completing a compliance risk assessment provides insight into other areas of compliance and risk that may not otherwise be apparent. This knowledge enables you to identify gaps in your organization and leads to the creation and testing of mitigating controls that ultimately strengthen every department at your company.

Using a robust system like LogicManager to conduct your compliance risk assessments allows you to streamline your processes, easily engage with front line employees and give greater insight into the most critical day-to-day operations. Get started with our out-of-the-box Compliance Risk Assessment solution.

Risks

By ignoring the implications of your regulatory risk, you put your company at a competitive disadvantage. Employee prospects, existing customers and business partners alike don’t want their name associated with an organization that cannot meet regulatory requirements.

Failure of the adherence to compliance regulations not only puts your customers at risk of any threats the regulation aims to prevent, but it also can lead to monetary losses for your company. At the very least, you don’t have ample evidence to prove compliance and you’re up against fines (and increased scrutiny). In the worst case scenario, you have no way of demonstrating compliance and become subject to criminal penalties.

Request a DemoLearn How LogicManager’s Compliance Risk Assessment Tools Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.